If you are considering a reverse mortgage, or researching one for a parent, friend, or client, we suggest you educate yourself on some of the most important features of the line of credit. A reverse mortgage line of credit used in the right way can be a valuable financial planning tool.

HELOC vs. RMLOC

Unlike a traditional home equity line of credit (HELOC), a reverse mortgage line of credit (RMLOC) cannot be altered, frozen, or cancelled due to shifts in the housing market. A RMLOC can only be frozen when a client no longer meets the terms of the loan. The conventional wisdom has always been that you should take out a HELOC to cover variable expenses in retirement, especially when you own your home free and clear. That advice, often due to the low upfront cost of a HELOC, was not well thought out in many situations. Take for instance, the time period 2004-2007. The majority of Americans took out a HELOC against their home. When the market crashed in 2008, the banks froze many lines of credit due to a reduction in home values. There is a lot of risk in the availability of funds as you also have to consider the health of the bank doing the lending.

The other major issue with HELOCs that is often overlooked is the balloon feature. It is common to see a HELOC be an interest only loan that has a ten year balloon payment. That means the entire loan balance must be repaid ten years after you take out the loan. Banks often will renew the loan at the end of the ten year term, but you have to re-qualify for the loan with credit, income, and a new appraisal. What happens if you lost a spouse and half your income or had some credit problems due to medical bills? Now that you have to qualify for reverse mortgages, they are not the backup option they once were to bail you out in that scenario. They should be used more frequently for those entering retirement than HELOCs. The only reason they are not is due to the financed closing costs being higher, but that can be mitigated by having a portion of the loan drawn at closing.

Monthly Compounding Growth

The most exciting feature of a reverse mortgage is that the line of credit is not a fixed amount. The unused portion of the variable rate loans, what we consider the line of credit, grows monthly. The growth is based on the current interest rate plus the mortgage insurance rate (1.25% at the moment). If the starting interest rate on your loan is 3.75%, then your annual growth rate for the first year would be 5.00%. Keep in mind with monthly compounding, that real return is greater than 5.00%. As the rate adjusts annually, so does the line of credit growth rate. Reverse mortgage interest rates, for the annually adjustable product, are based on the one-year LIBOR index plus a lender margin in the 2-3% range. There is a cap on the maximum rate, so the highest the rate could increase to is 8.75% in this scenario. That would be a 10.00% RMLOC growth rate.

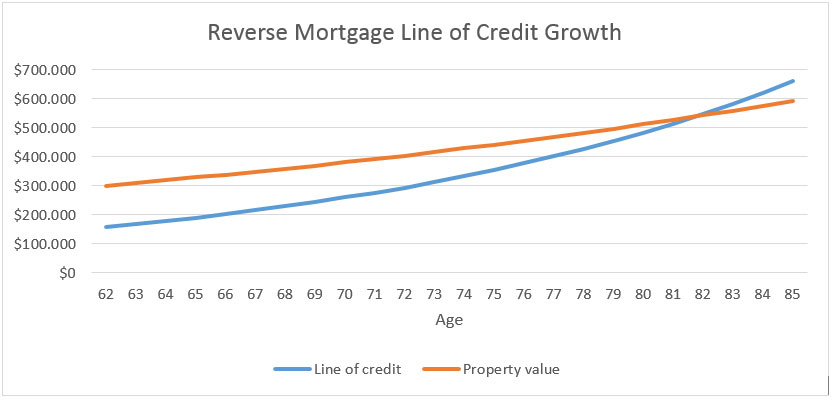

In the chart below, we want to illustrate what happens when you take out a reverse mortgage at 62 with the intention of not using the funds until you have exhausted your other retirement assets. As you can see, the line of credit exceeds the home value at 82. The chart assumes the client was 62 years old at the time of the loan, had a $300,000 home, and paid the closing costs out of pocket. The expected rate was below 5.06%. Property appreciation is a steady 3% per year. The initial interest rate remains at 5% throughout the loan and the mortgage insurance rate is 1.25%.

The concept is that, as you age and your home value increases, you are able to borrow more money. HUD is gambling that your home will still be worth more than the loan balance when it is time to repay the loan. The FHA insurance they collect on reverse mortgages mitigates their risk, to some degree. One thing to keep in mind about RMLOCs is that they are not paying you interest like a savings account does. With that being said, the growth in a RMLOC does not have much value to someone that never draws any funds, for one reason or another. On the other hand, to someone that takes out a RMLOC at 62 and does not use it until 85, it is a game changer. After 23 years of growth, the RMLOC will have exceeded the initial home value, and potentially the current home value. Compare that to other options available to an 85 year old that desperately needs funds.

Flexible Payment Strategy

Reverse mortgages were designed as a cash flow tool, and the majority of customers to date have used them as such. With that in mind, making payments is not something they are interested in. Generally speaking, the typical clients from 1989-2014 have waited to take out a reverse mortgage until they absolutely need it. That means they have a low income, consisting of social security, and are running out of retirement assets. With new qualification rules, and more attention being paid to reverse mortgages by financial advisors, we are seeing a more savvy customer base that uses reverse mortgages in a variety of ways. Most of them involve a line of credit, and may involve making payments at some point.

Before the subprime fiasco that occurred in 2008, there was a loan product called an option arm. It was given this name due to the ability to make a very low payment (loan balance increases), an interest only payment, or a fully amortizing payment. Many folks took advantage of this product due to the flexibility in payment options. It was beneficial to them if they had variable income from month to month or year to year. Option arms are no longer available, but reverse mortgages allow those same payment options. There are several other advantages to making payments on a reverse mortgage, including having a mortgage interest tax deduction, protecting equity, and keeping the loan balance from compounding monthly. We recommend making payments for those that have the income to it and particularly for those that intend to sell their home in the mid-term (7-15 years).

Home Value Swings Have No Impact

One of the positive features of a RMLOC is that they are not tied to home value, outside of the initial loan amount being a percentage of home value based on the youngest spouse’s age and the expected interest rate. If you take out a RMLOC as an emergency fund that is going to be used once you run out of other liquid assets, then removing home value volatility risk is beneficial.

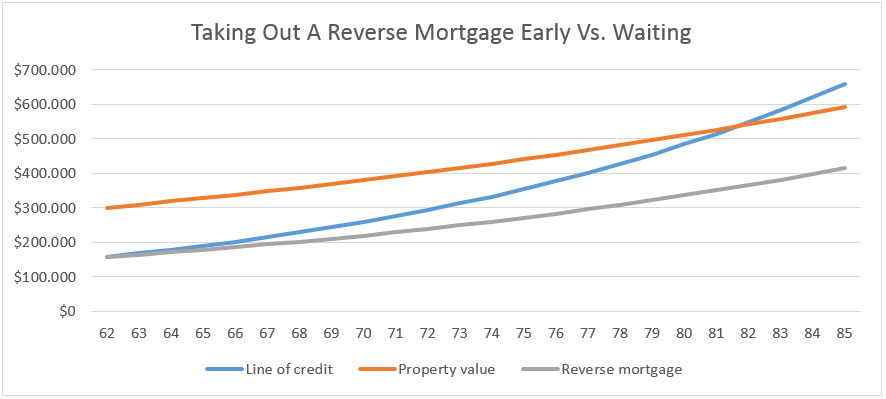

Considering how risk averse most people are as they get closer to retirement, why would you gamble with one of your largest remaining assets? Assuming you will need to tap into your equity at a very specific unknown future date, will your home value be at a peak at that time? Individual pieces of real estate are some of the most risky assets to own. If you owned property in 2008-2009, you saw that first hand. You remove that risk by taking out a RMLOC as early as possible and letting it grow until you need the funds later in life.

In the chart below, we want to illustrate what happens when you take out a reverse mortgage at 62 vs. waiting until later in life to do so. As you can see, at 85 years old there’s a pretty large spread between the line of credit taken out at 62 and what a reverse mortgage taken out at 85 would look like. The chart assumes the client was 62 years old at the time of the loan, had a $300,000 home, and paid the closing costs out of pocket. The expected rate is below 5.06% for all scenarios. The initial interest rate remains at 5% throughout the loan and the mortgage insurance rate is 1.25%. Property appreciation is a steady 3% per year. Line of credit shows the loan taken out at 62 and growing. Reverse mortgage shows what the loan amount would be at that particular age and home value.

One other neat feature about a RMLOC, depending on your perspective, is that you can withdraw the entire line once twelve months have passed. Let’s say you take out a RMLOC at 62 years old and do not make any withdrawals. Over the next 23 years, you lose your spouse and decide it is time to move to an assisted living community. Your RMLOC balance exceeds the current market value of the home by over $60,000. You have the option to cash out your entire RMLOC, sign the deed over to the bank in lieu of foreclosure, and walk away. There are credit and tax implications involved in this strategy, so you would need to consult an estate planning attorney about doing so. The alternative is to sell the home yourself and the RMLOC will be closed once the transaction is complete.

Increasing Interest Rates Impact The Starting Balance

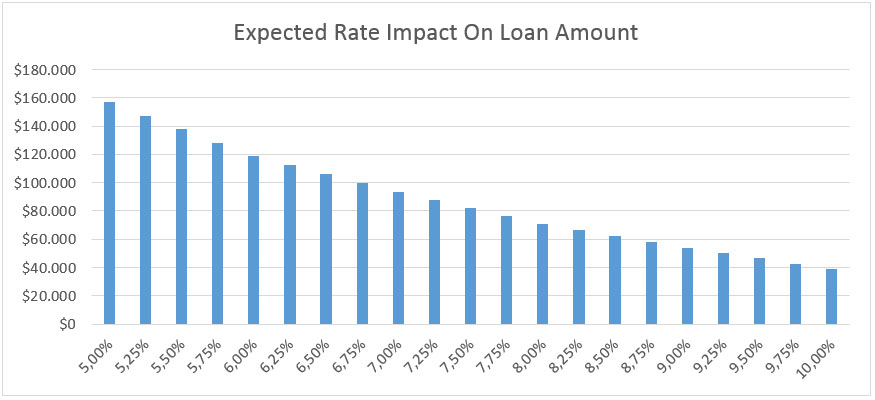

One of the most important factors to consider when talking about a RMLOC is the expected interest rate. The only factors that are used to determine the principal limit (initial loan amount) are the home value, the age of youngest spouse, and the expected interest rate. If the expected rate is below 5.06%, the principal limit will be the maximum allowed for that someone that age. As the expected rate rises above 5.06%, rounding up to the nearest eight of a percentage, the principal limit drops significantly. The expected interest rate is based off of the 10 year SWAP rate plus the lender margin of 2-3%.

In the chart below, we want to illustrate what happens when take out a reverse mortgage in a high interest rate environment. As you can see, the loan amount is significantly impacted by the expected rate being above 5.06%. The chart assumes the client is 62 years old and has a $300,000 home.

The expected interest rate used to set the principal limit is not the same as the initial interest rate. The initial interest rate is the rate at which the loan balance accrues interest and the rate that factors into the RMLOC growth rate. It is based off of the one-year LIBOR index plus the lender margin of 2-3%. Since the expected rate is a one-time rate, used to set the initial loan amount only, it is important to try to take out a reverse mortgage when the expected rate is at or below 5.06%. After you have done that, having an increase in the initial interest rate is not a bad thing if you have a large line of credit, due to the growth rate being tied to the prevailing interest rate plus 1.25%.

Seem Complicated? We Can Help!

Give us a call at (800) 996-5361 or email us to have us project how a reverse mortgage line of credit could benefit you.

We will ask about your current financial situation to help suggest how you can best use a line of credit to make your retirement assets last as long as possible.

2 Responses

I have contacted 3 companies and have received 3 different amounts for my LOC. All were given the same info and numbers by me. Why the discrepancy?

Thank you for the question Maryann. The answer is that the closing costs vary by company, along with the interest rate margin offered. The higher the interest rate margin, the lower the loan amount or line of credit. The terms also change every Tue until you apply, so if you get quotes at various times, the interest rate that week will have an impact.